I hope you’re keeping safe and sane, in what is a really insane time in our history.

Amongst all the uncertainly of this pandemic, my hope is to educate and empower you to make clear decisions for your business over the coming months. The way to achieve this, is by putting a stability plan in place.

In this article, I outline the steps and provide you with the tools to do create such a plan. It will focus on forecasting and managing your cash flow, as well as understanding the significant Government stimulus initiatives that you’re able to utilise. A key benefit of creating a stability plan for your business, is it will no doubt reduce the anxiety spurred on by the uncertainty of these times. Control and clarity to make swift decisions are what businesses need right now.

Firstly, I want to stress that what we’re experiencing at the moment is not normal. But, when we pause to reflect on our past, we realise we have all been through crises before. Loss of a business, loved one, relationship…I won’t dwell any further. The key point I want to make though, is, we have the ability to be resilient and pivot our way over this pandemic bridge. And, once we have a stability plan in place, we can start to open our minds up to what we want our business to look like on the other side.

The fact is, we don’t often get these breaks that provide us with space to look at our business with refreshed eyes and perspective. The likes of Uber, Slack, Airbnb, and WhatsApp were all created during the GFC. Doom certainly isn’t the only outcome of our current gloomy situation.

So, what does a Stability Plan involve?

- Evaluating your cashflow position, considering a worst- and best-case scenario, is key for clarity.

- Analysing strategies that bridge any cashflow gap, such as:

- Access to Govt stimulus initiatives – understanding what they are,

and how to access them. - Cutting costs, in line with your cash shortfall.

- Considering a SME Bank loan (up to $250,000).

- Access to Govt stimulus initiatives – understanding what they are,

- Reviewing opportunities to change the way you ‘do business’ and generate revenue.

- Leadership; thinking about what you want your new normal to look like.

So, what are the steps to creating a Stability Plan?

STEP 1 – Evaluating your cash flow position

It’s important for you to understand the impact of COVID-19 on your business, as well as your personal position. All so you can make informed decisions as to what to do next.

To do this, you need to conduct a cash flow forecast to understand any revenue impact.

- Assess your income – the key driver of your future cash flow.

Key point: Income drives the ability to pay costs – i.e. staff, rent, etc. So, forming a view on any income adjustments will help you decide what to do next.

-

- Assess the impact on your sales over the next 6 months

- Forecast your likely sales (based on your best estimate), month-by-month, for next 6 months

- List your current projects – and consider how they’ll be affected

- Review projects in your pipeline – to see how they’ll be affected

- Talk with strategic partners – i.e. builders, Govt, etc. – to assess the impact of the pandemic on their business operations.

- Estimate the timing of your upcoming payments (not just when work is done.)

- Apply your existing cost base from your profit and loss (expenses) to your sales forecast.

-

- So, if you were to make no decisions on cutting costs, what would that scenario look like for your forecast?

- Adjust your cashflow (non-profit and loss items) to capture all other outlays. Include, items such as:

-

- Receivables and payables – what is the timing re: collection and payment

- Repayment of principal debt – i.e. any business loans

- Any existing payment arrangements with the ATO

- Capital expenditure – i.e. equipment, subscriptions, etc.

- Timing of your staff’s superannuation payments – quarterly v monthly

- **Personal drawings (outside wages)

- Adjust your personal cashflow to minimise overall spending. Some strategies to consolidate, include the following:

-

- Defer loan repayments – speak to your bank

- Defer Tax payments – speak with your accountant

- Seek rent assistance – speak with your landlord

- Defer capital expenditure

- Minimise discretionary spending – holidays, entertainment.

STEP 2 – Analysing strategies that bridge any cash flow gap

Now that you have evaluated your position, it’s time to analyse and implement strategies to ride out the storm. Your goal should be to neutralise your cash shortage, each month. To do this, firstly you should evaluate your Govt. stimulus, cost reduction and cash savings, opportunities.

- Evaluate your Govt. stimulus – opportunities

Then: apply what you’re eligible for to your cash flow model and then reassess your cash flow shortfall.

TOOL – if you would like a summary of the Stimulus Initiatives, you can find it here.

2. Evaluate cost reduction – opportunities

-

- Wages / contractors – staff

- Rent – speak to your landlord to defer / reduce rent

- Discretionary spending: i.e. entertainment, non-essential subscriptions, new projects, etc.

- Debt repayments – speak to your bank

- Tax – defer payment on tax

- **Personal wages

Then: apply any of these cost reduction opportunities to your model, before finalising it and making any big decisions.

- Evaluate your cash savings – opportunities

a) Review your personal budget and take the same cost-cutting approach, as mentioned above.

-

- Bank – speak to your bank to defer payments

- ATO – speak to the ATO to defer payments

- Reduce / cut spending

- Rent – speak to your landlord

b) Do you have any business cash reserves that you can contribute?

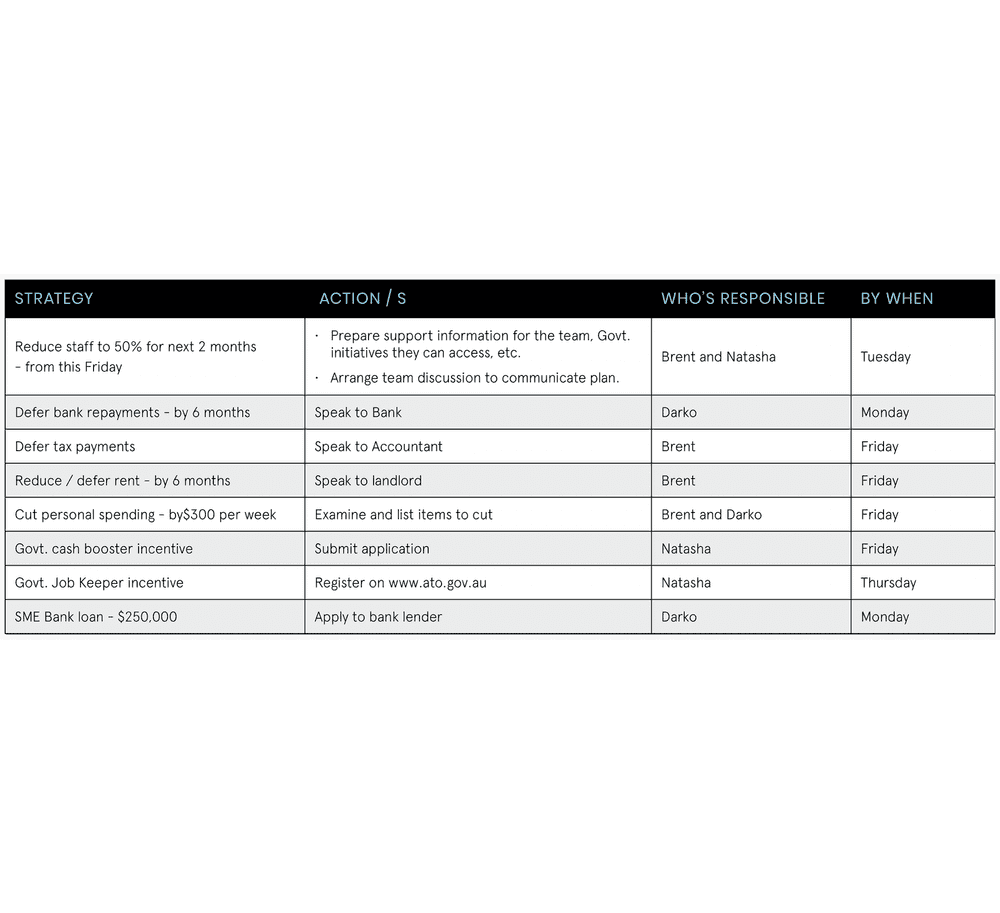

Once you analysed your opportunities to bridge your cashflow gap, list those you plan to implement into an action table, such as below. This is a key part of your management plan. Other important tactics to stay accountable to your plan, are:

- Nominate and meet with an appropriate person to assess and reassess your cashflow forecast – weekly

- Adjust your cashflow model according to new information

- Work with external advisors to keep informed (such as your Accountant)

- Look after yourself – take care during this stressful period.